Oil & Gas Journal sayeth here

Energy prices soared to new highs on Aug. 10 as traders ignored a build in US crude inventories and worried instead about possible supply disruptions, including international concern over Iran's nuclear program, tightness of US refining capacity, and threats from the Atlantic hurricane season.For more on the need for more refining capacity, see here, here, here, here, and here. The following chart is from the last link:

'The Iranian nuclear issue has been lurking in the shadows for a considerable time,' said Paul Horsnell with Barclays Capital Inc. in London. 'It has now come further to the fore in a market [that] is naturally concerned by potential supply outages, a market that has very little remaining slack.'

He said, 'Refining remains the key bottleneck within the oil system, and the frailty of the US system in particular when being run to, and sometimes beyond, sustainable limits is a source of upside price risk.'

It's more complicated than just oil wells...

Update: I see Megan McArdle is on the refinery issue and points to an article in Slate.

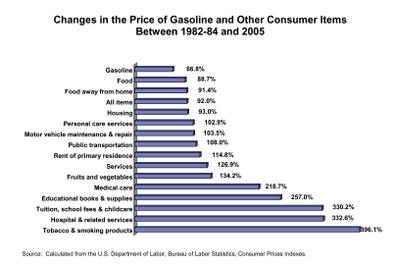

Update2: From the American Petroleum Institute (yes, there might be some bias) , an interesting price increase comparison (click on the graph to make it bigger):

Wow, look at those price increases in the medical and education areas!

Update3: Just to complete the cycle:

Update4: Professor Bainbridge says "Yikes!" about $3 a gallon gas. I wonder if he has said the same thing about the stunning increases in education costs, such as tuition (see graph at Update2 above)...or maybe we just notice the gas prices more because they are posted on almost every street corner.

No comments:

Post a Comment